Contents:

BEIRUT – Lebanon’s commercial banks do not have enough liquidity to pay back depositors, the secretary general of the country’s banking association said on Wednesday in… By Peter Nurse Investing.com – The U.S. dollar edged lower in early European trade Friday ahead of the key monthly jobs report, and the yen weakened after the Bank of Japan… By Geoffrey Smith Investing.com — The dollar was up in early trading as the market adjusted its view of the likely path for U.S. interest rates again in the wake of February’s… By Ambar Warrick Investing.com — Most Asian currencies kept to a tight range on Thursday amid renewed concerns over a U.S. and European banking crisis, with investors largely… The crypto industry took an impact following the failure of three banks in the United States. The Blockchain Association is thus taking charge of investigating how the denial of banking services for crypto businesses might have contributed to the banking crisis.

Keep in mind, however, that forex trading involves exchanging one currency for another, so exchange rates reflect relative rather than absolute values. Traders are drawn to forex news trading for different reasons but the biggest reason is volatility. Simply put, forex traders are drawn to news releases for their ability to move forex markets.

By following our news, this ensures that you are always up-to-date with the latest trends and changes within the financial markets, as well as general economic announcements. Some brokers offer automated news trading signals that can help a trader to make decisions on whether to enter, exit or avoid a trade. These hints are based on price fluctuations after a certain type of news release and can 6 best day trading apps of 2021 prompt traders to either buy or sell an asset. As with other asset classes, forex trading news can become particularly active before and following major economic events. However, there are significant differences between the type of news that sets apart currencies from other financial markets. Trading post-release involves entering the trade after the market has had some time to digest the news.

Why Trade the News?

This includes analysing its growth rate potential, as well as any potential legal, political or insolvency risks. Financial ratios such as price/earnings along with dividend yields can also indicate whether a stock is a healthy investment right now. What’s important if you’re watching these news announcements is to read the analysis and expectations ahead of time. Placing a trade after the data or rates are released might be too little too late. You need to do your research, plan your trade and make sure you have a risk management plan in place if your prediction is wrong.

An economic announcement is rarely enough to quickly change a medium-term trend, but how the market reacts to surprises can give the first clue that sentiment is starting to shift. This offers traders an opportunity to open positions at the very start of a new trend. Our news and analysis section is updated daily with articles on the forex, share, treasury, commodity and index markets, written by our market analysts. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. We’ve seen the rise ofReddit forumsempowering retail traders to take on Wall Street, and Elon Musk single-handedly wiping millions off his own company’s value with a tweet.

Risks of news trading

Rather, there are a limited number of major news releases that have previously produced the greatest potential to move the market. For example, a proactive news trading strategy can involve formulating an idea of what the data release will be. This expectation is then compared to the market consensus to determine whether it will surprise the market and send the exchange rate higher or lower. If you have a strong stomach and sufficiently deep pockets to participate in news trading, you can look into various news trading strategies that can work in the forex market. Forex news traders employ a number of different strategies for coping with and/or profiting from data releases. Like many prudent forex traders, you might decide to stay out of the market during these news releases because holding a position in a wildly swinging market can raise your stress levels.

The Australian dollar is feeling the strain of housing-related headlines today, with mortgage arrears on the rise and dwelling approvals on the decline. If the RBA deliver another 25bp hike tomorrow, it will take their cash rate to a 10-year high of 3.6%. After a combined 425 https://day-trading.info/ basis points worth of hikes, the BOC has already signaled it would pause tightening to let the economy digest impact of previous hikes. The SNB has swept in to provide much needed liquidity to Credit Suisse, which should soothe some concerns over risk to the financial system.

- For the most part, it’s only the big-ticket items that move the needle, such as interest rate announcements, GDP and CPI releases.

- Because of the volatility and how capital-intensive trading a news release can be, the strategies described above will probably work best for seasoned and well-capitalized forex traders with nerves of steel.

- These can include changes to interest rates, inflation, unemployment levels or retail income for a specific country and these all have a significant effect on the financial markets and overall state of the economy.

- When market movements cause either order to be filled, the unfilled order is automatically cancelled.

- They will go ahead and start selling off their dollars for other currencies before the actual number is released.

Fundamental analysts routinely evaluate key economic factors for one country and compare them against those same factors for another country to arrive at a relative economic outlook. This assists them in making an exchange rate forecast for a currency pair that involves the two currencies of those two nations. You should remain cautious when leaving stop-loss orders ahead of important economic data releases. The abnormal order slippage often seen during highly volatile markets can result in your stop order being executed at an unexpectedly unfavorable rate on an extreme spike or dip just before the market retraces.

Forex News

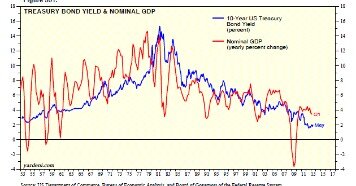

By Ambar Warrick Investing.com — Most Asian currencies traded in a flat-to-low range on Wednesday as data showed a somewhat mixed recovery in the Chinese economy, while the dollar… By Peter Nurse Investing.com – The U.S. dollar retreated in early European trade Thursday and the euro pushed higher as Credit Suisse’s move to bolster its financial position… In a true sign of confidence returning to Wall Street, Treasury yields are heading up as markets digest the news that Credit Suisse intends to access two facilities from the Swiss National Bank. The chart above illustrates—with two horizontal lines forming a trading channel—the indecision and uncertainty leading up to October non-farm payroll numbers, which were released in early November. Note the increase in volatility that occurred once the numbers were released. This method disregards a directional bias and simply plays on the fact that a big news report will create a big move.

European Open: SNB come to the rescue of Credit Suisse, ECB up … – FOREX.com

European Open: SNB come to the rescue of Credit Suisse, ECB up ….

Posted: Thu, 16 Mar 2023 06:41:29 GMT [source]

The cost or benefit from these rollovers can affect whether traders prefer to be long or short a currency pair overnight. If the news release requires a few days or weeks to materialise, your trading positions may be open over several days. This brings overnight risk and may require you to pay additional holding costs. Therefore, traders should ensure that they have sufficient funds in their account to cover these costs.

Shares news and analysis

A technique used to forecast a CPI release involves reviewing the PPI numbers that come out before the CPI and reflect changes in producer prices. If the PPI number shows an increase, then a good chance exists that the CPI will also increase down the line. Within each of these sector reports, a subcomponent for employment can be found. If a significant increase in employment occurs in these reports, then a good chance exists that the increase would also be reflected in the unemployment rate and the NFP number. Yesterday’s bounce in US Treasury yields has been erased as investors have continued their flight-to-quality, with a key ECB rate decision on the calendar for tomorrow.

The release of these numbers, as well as important geopolitical news, can often exert a strong influence on a country’s currency. Because these news events can move exchange rates significantly, it pays to keep a keen eye on what news is being released and when. How Central Banks Impact the Forex Market Discover how policies and interest rate hikes of central banks impact forex and trading decisions. This means that you can handpick the currencies and economic releases to which you pay particular attention. But, as a general rule, since the U.S. dollar is on the “other side” of 90% of all currency trades, U.S. economic releases tend to have the most pronounced impact on forex markets. Our Morningstar equity research reports are updated regularly with new information about company fundamentals.

‘News’ refers to economic data releases such as GDP and inflation, and forex traders tend to monitor such releases considered to be of ‘high importance’. At a minimum, you should develop and practice a sound news trading strategy you can use to cope with the extreme exchange rate volatility that can arise from an unexpected news result. Major economic data has the potential to drastically move the forex market. It is this very movement, or volatility, that most newer traders seek when learning how to trade forex news. This article covers the major news releases, when they occur, and presents the various ways traders can trade the news.

This analysis process can help a trader come up with a more accurate exchange rate prediction. NFP number and U.S. gross domestic product , for example, tend to provoke strong reactions in the forex market, especially if they deviate significantly from analyst expectations. Such numbers can provide opportunities for short-term news trading strategies. In general, the fall in the euro tracked the collapse in short-term bond yields in the eurozone. In particular, news trading requires expert fundamental analysis skills, as you will need to understand how certain economic announcements can affect your positions and the wider financial market.

Consumer Price Index (CPI)

It’s important to keep track of the market consensus and the actual numbers, you can better gauge which news reports will actually cause the market to move and in what direction. Now let’s revisit this example, but this time, imagine that the actual report released an unemployment rate of 8.0%. However, when you go to your trading platform to start selling the dollar, you see that the markets aren’t exactly moving in the direction you thought they would. Now let’s say that the actual unemployment rate is released and as expected, it reports 9.0%. Determine significant support and resistance levels with the help of pivot points. Hot inflation is likely to outweigh concerns over financial stability, potentially leading the ECB to disappoint market’s substantial re-pricing of policy rates.

This allows for the losing side of the position to make back some money when the market snaps back after its initial exaggerated reaction to the release. Giving equity sales traders and research sales an edge through 13F filing analysis, portfolio management, news/event reporting tools and prospecting by region and industry sector. Covering worldwide breaking news and instant analysis 24-hours-a-day for currency, bond, treasury, fixed income, futures and FOREX traders. By Ambar Warrick Investing.com — The dollar fell sharply against a basket of currencies on Monday as markets reassessed their outlook for future interest rate hikes by the Federal… The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies. Depending on the current state of the economy, the relative importance of these releases may change.

The economy of a country has a direct influence on the evolution of the national currency. That is why it is important to know the events that can mark the evolution of a currency in one way or another, as well as their correct interpretation. Rothschild then sold stocks publicly on the London Stock Exchange thereby giving the market the false impression that Napoleon had won and prompting a substantial sell-off. He then privately bought as much stock as he could at the lower prices he had induced before the market eventually caught wind of the real news and rallied. This well-known adage refers to how the market often responds sensibly to rumors of an event, but it then corrects in a counter-intuitive manner once the news arrives and profit-taking sets in.

That is just one of the various ways forex market participants can trade the news. With volatility and headline risk remaining high, we take a look at some of the key drivers and how to approach the currency market under such conditions. Seeing strange movements in a stock or a currency pair – ask us «What just happened» live.. By Ambar Warrick Investing.com — Most Asian currencies fell on Friday as markets turned cautious ahead of key U.S. labor market data due later in the day, while the Japanese yen…

Gold Insights

This generally means that the trader has researched the economies of both nations thoroughly. This gives them the background to know immediately whether the impact on the currency pair’s exchange rate should be positive or negative. Since the dollar is one side of many currency pairs, U.S. economic releases tend to have the most pronounced impact. Read more about using fundamental analysis in the consideration of external factors as part of your news trading strategy. Because the forex market is very volatile during important news events, many forex brokers WIDEN the spread during these times. At the start of each trading day, you must verify the economic calendar for the most important releases of economic indicators.

For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. The most common way to trade news is to look for a period of consolidation or uncertainty ahead of a big number and to trade the breakout on the back of the news. After a weak number in September, the euro was holding its breath ahead of the October number, which was to be released to the public in November. ChatGPT has several limitations to trading live markets, but there are other AI options designed specifically for traders who want to start algo trading. The meetings provide opportunities for both day traders and longer-term traders.